Over the past year, India’s leading food delivery company, Zomato Ltd., has delivered a remarkable 121% rally in its stock price. As of now, both Zomato and its primary competitor, Swiggy are all the buzz at the Bombay bourses. This analysis delves deeper into Zomato’s business model, explores its future trajectory, and evaluates whether its current valuation aligns with a long-term value perspective. The investment philosophy guiding this analysis prioritizes companies with a consistent track record

of generating free cash flows, robust competitive advantages (MOATs), and prudent management teams. Among these criteria, Zomato appears to fully meet only one.

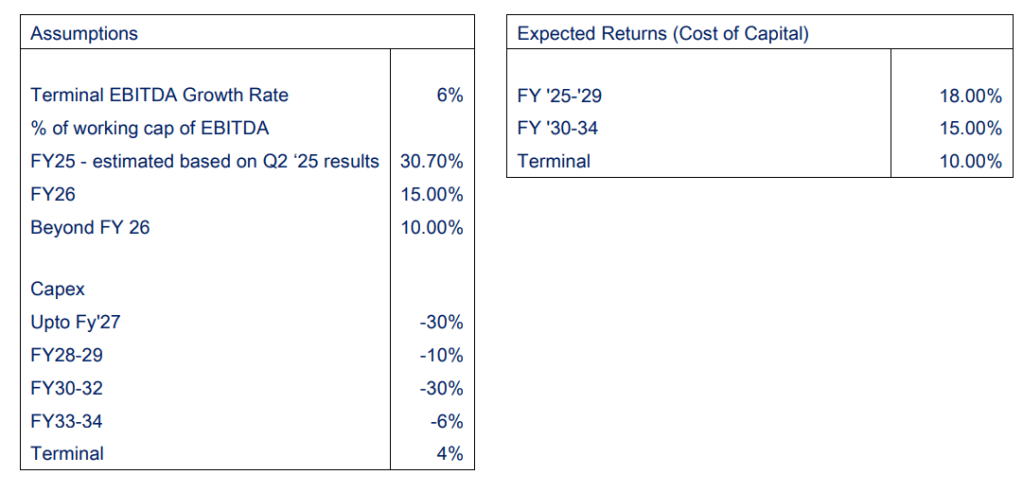

The analysis begins with the hypothesis that food delivery businesses, characterized by high operating leverage and scalability with minimal capital expenditure (capex), differ fundamentally from quick commerce businesses, which require significant capex for growth due to their reliance on retail and last-mile delivery. So, while it may make sense to apply an EBITDA multiple to a tech/platform business, one would have to focus more heavily on the capex outlay for a quick commerce business. To address potential biases, the valuation process incorporated highly optimistic growth assumptions for Zomato. Despite this bullish outlook, the intrinsic valuation arrived at a figure lower than the current market price. Following this, the operating, valuation, and macroeconomic risks associated with the company were examined in detail.

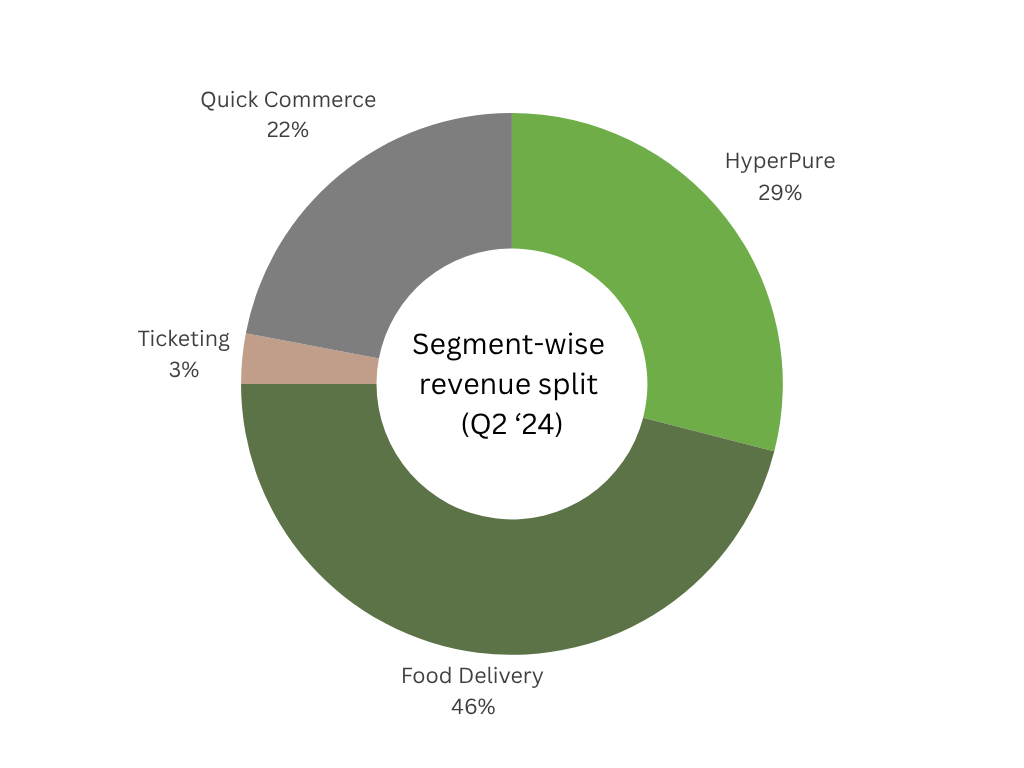

Zomato is divided into four verticals Food delivery, Quick Commerce (Blinkit), Ticketing, and Restaurant Supply chain (HyperPure). Currently, the food delivery segment contributes the largest share to revenue, accounting for 46% of the company’s topline. However, due to the rapid

growth and immense market potential of the quick commerce segment, it is expected to surpass food delivery in the coming years.

Notably, Zomato’s food delivery business is the only segment currently EBITDA-positive. In contrast, Blinkit, its quick commerce arm,

is yet to achieve positive EBITDA. While many of Blinkit’s older stores have reached profitability, the division’s overall performance is weighed down by newer stores that require time to become operationally profitable.

Valuation

The intrinsic valuation for Zomato yielded a price of approximately ₹138 per share, even under optimistic assumptions regarding the company’s growth trajectory. It is worth emphasizing that valuations for new-age companies are particularly sensitive to terminal assumptions, with small adjustments significantly impacting the outcomes. A sensitivity analysis was conducted to illustrate the effects of varying discount rates on the valuation. Further details are provided in the annexures, which include a discussion of the methodology behind EBITDA projections, capex growth assumptions, and other key inputs. An extract of the discounted cash flow analysis is also included for reference.

Risk Factors

Below are a few key risks we believe investors should consider apart from the valuation risk for a company like Zomato.

- Not Exactly a Necessity

Zomato’s services are more “nice-to-have” than essential. In tough economic times, people might skip that ₹400 biryani delivery for a home-cooked meal, binge on YouTube instead of attending a concert, or brave the city traffic to stretch their grocery budget. These aren’t great scenarios for Zomato’s bottom line. - The Loyalty Problem

In a market like this, loyalty is as fragile as a soggy French fry. Customers are happy to hop between platforms, choosing whoever offers the best deal that day. Without a strong competitive edge—beyond operational efficiency—Zomato risks being stuck in a market always ripe for new entrants. Not exactly the dream scenario for long-term profitability. - Riding the Income Gap

A big part of Zomato’s affordability hinges on India’s income disparity. While delivery costs are manageable today because of low wages for gig workers, any rise in wages or stricter labor laws could throw a wrench in this equation. If the gig economy becomes pricier, Zomato’s cost structure—and by extension, its pricing power—takes a hit.

Conclusion

Zomato’s vision is bold, its growth story captivating, and its business model diverse. However, the company faces considerable hurdles, from wafer-thin margins and capital-intensive expansions to fierce competition and reliance on discretionary consumer spending. While the food delivery and quick commerce segment shows solid promise, the relatively modest contributions from other verticals raise questions about Zomato’s ability to generate consistent, long-term value. At current valuations, the stock feels stretched for a long-term investor. The upside potential is heavily reliant on flawless execution across divisions, significant margin improvement, and continued dominance in competitive markets. For short-term traders, momentum and optimism might provide

opportunities, but for those with an eye on sustainable free cash flow and defensible competitive advantages, Zomato remains a high-risk, and low to moderate-reward proposition. Zomato might succeed in delivering your food in 30 minutes, but delivering long-term value for shareholders? That’s going to take some work.

Note: The original report was published on 23rd November 2024.

Annexures and Footnotes

Divisional Analysis

Food Delivery

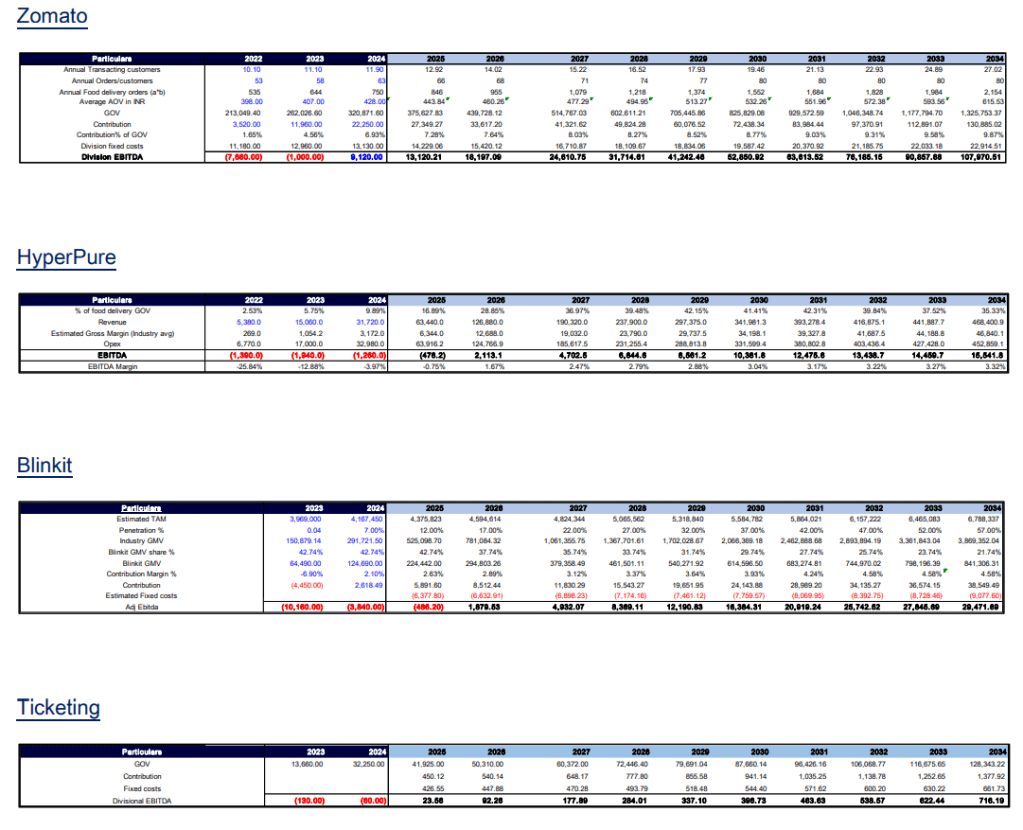

According to Zomato’s FY24 report, the platform boasted 11.9 million annual transacting customers, each placing an average of 63 orders. This translates to approximately 750 million orders annually. With an Average Order Value (AOV) of ₹428, Zomato achieved a gross order value (GOV) of around ₹321 billion. From this, it generated ₹22.25 billion in contribution at a margin of 6.93%. The food delivery division closed the year with an EBITDA of ₹9.12 billion, implying other divisional costs of ₹13.13 billion. These costs have remained relatively stable over the past three years, tracking inflation, and projections assume this trend will continue. As of 2023, India’s urban population stands at approximately 519 million. With Zomato’s active user base of 11.9 million, only about 2% of urban Indians currently use the platform. By 2035, the UN estimates India’s urban population will rise to 675mn1 , Assuming incomes grow and 4% of urban dwellers become Zomato customers, the user base could reach 27 million. It is also assumed that order frequency rises from 63 orders per year per customer to 80 (about one order every four

days—something your doctor may not recommend, but hey, convenience is king), and AOV continues its 4% annual growth trend, which is what Zomato have been able to achieve thus far. Furthermore, it’s assumed that Zomato will increase its platform fees and take rates to achieve a contribution margin of 10% by 2034. (Ambitious? Yes. Possible? Maybe. Exciting? Definitely.) These assumptions result in a projected adjusted EBITDA of ₹107.97 billion by 2034, a compound annual growth rate (CAGR) of 30%.

HyperPure

Zomato’s restaurant supply division, Hyperpure, is best analyzed as a restaurant wholesaler rather than a shiny tech venture. Most Hyperpure customers are restaurants already transacting on Zomato, so its growth is closely tied to the food delivery GOV. Since Zomato provides limited data on Hyperpure, cost structures of other food wholesalers were used as benchmarks. Revenue for Hyperpure is growing rapidly, and the potential is significant. Assuming a 30% CAGR over the next decade, Hyperpure could generate an EBITDA of ₹15.54 billion by 2034. However, this growth will require disciplined execution, as the restaurant supply business is notoriously competitive and operates on thin margins. Still, Hyperpure represents an important diversification for Zomato’s revenue streams.

Ticketing

Zomato recently acquired Paytm’s ticketing business, taking aim at BookMyShow in India’s growing events and concerts market. (For those still recovering from Coldplay ticket stress: yes, tickets are hard to snag, but this segment remains an urban India story—for now. Enthusiasts predicting rural Satsangs2 going digital might be jumping the gun.)

The ticketing market is expected to grow at a 15% CAGR over the next decade, reaching a GOV of ₹128 billion. Assuming a steady contribution margin of 1% and relatively constant fixed costs growing at 5%, the ticketing division could achieve an EBITDA of ₹716 million by 2034. While not a game-changer, this segment adds another layer of diversification to Zomato’s portfolio.

Quick Commerce

And now, for the proverbial elephant in the room: Blinkit. (Though considering its promise of eight minute delivery, perhaps a nimbler metaphor is in order—a tiger with a tote bag, maybe?) Quick commerce has seen explosive growth in urban India, driven by the time-starved consumer willing to pay for the convenience of avoiding ceaseless city congestion and long queues after a long day. The Total Addressable Market (TAM) for quick commerce is estimated3 to be roughly INR 4.17 trillion or roughly $ 50bn. Currently, the industry has a GMV of ₹292 billion, reflecting a 7% market penetration. The EBITDA model assumes that the TAM will grow at 5% annually over the next decade, with market penetration rising to 57% by 2034. (Yes, that’s ambitious, but we’d like to give Zomato the best chance it’s got.) Blinkit’s current market share is 42%. However, with heavyweights like Amazon, Flipkart, and Reliance entering the fray, a decline to 22% market share by 2034 seems more realistic. Management also aims to achieve a contribution margin of 4.5% gradually over the next decade. Based on these assumptions, Blinkit’s EBITDA could reach approximately ₹30 billion by FY34.

However, expansion comes at a cost—quite literally. As of Q2 FY24, Blinkit operated 791 dark stores, adding 152 stores in the latest quarter at a cost of ₹2.14 billion, or about ₹14 million per store. With a target of 2,000 stores over the next three years, this implies a capital outlay of approximately ₹17 billion. (1,209 new stores * 14mn per store) In our opinion, this is what most people are understating the impact of while valuing Zomato.

DCF Extract

Present Value of Cash flows INR mn – 1,214,309

Number of shares in MN (diluted by ESOP) – 8,755

INR Value per share – 138.7

Share Price as on 22nd November 2024 – 264.89

Footnotes

- India’s Urban Population to Stand at 675 Million in 2035, Behind China’s 1 Billion, The Hindu (Aug. 30, 2022), available

at https://www.thehindu.com/news/national/indias-urban-population-to-stand-at-675-million-in-2035-behind-chinas1-billion-un/article65584707.ece. ↩︎ - Read: spiritual discourse ↩︎

- JM Financial, Deep-Dive: Quick Commerce (Feb. 29, 2024), available at https://www.jmfl.com/Common/getFile/3278. ↩︎